Add in the teacher's union , new fire station, new town hall, new welcome center, new zillion dollar schools..........asher2789 wrote: ↑Feb 27th, '24, 07:45 every time people complain about their property taxes going up, especially for education, just remember that

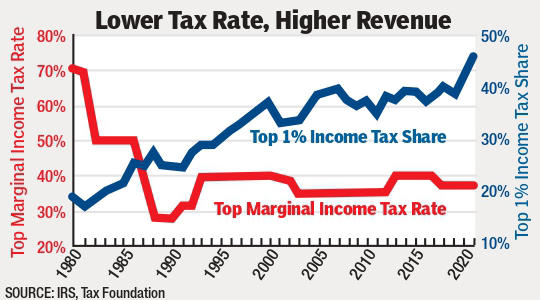

1. the feds have defunded education over the past few decades due to neoliberalism, federal taxes on the wealthy went from 90%!!!! in the highest bracket around ww2 to a lower percentage than average workers pay. youre being ROBBED.

2. universal healthcare would solve a lot of problems as much of the costs that go up in education are due to extortion from middleman healthcare insurance companies that do nothing but deny healthcare and are leeches sucking up profits and delivering nothing of value except ill gotten gains to the shareholders

3. that we could have nice things but were too busy bombing the middle east for the past 40? 50? years. never forget, israel has universal healthcare and higher education. our 51st state pays no taxes but gets hundreds of billions of dollars from us to wage a genocide.

just remember those things every time you feel squeezed. your taxes havent served you for decades, your taxes fund the military industrial complex.

Schools are well funded - need to get back to math, liberal arts, and science - not hockey rinks and fake turf fields..........